Paxos Seeks OCC Trust Charter; NY AG Sues Zelle; MeridianLink Acquired

.png)

July inflation clocks in at 2.7%. Student loan borrowers aren’t paying. Paxos seeks OCC trust charter. NY Attorney General files Zelle suit. Casap, Riva, Transak announce fundraises. Western Union acquires Intermex. MeridianLink acquired for $2Bn.

Cross River built its own 24/7/365 payment network for partners — settle in real-time, at any time of day, without volume limits or banking-hour time constraints. Our newly launched partner ecosystem moves fiat at the same speed as digital assets. Learn more.

New here? Subscribe here to get our newsletter each Sunday. For even more updates, follow us on LinkedIn.

“The Fog Is Lifting,” Richmond Fed Pres. Says

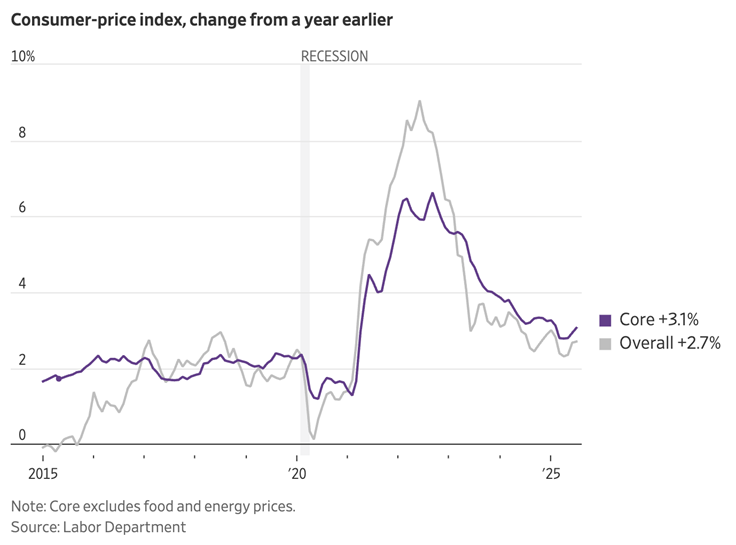

Even with some tariffs beginning to bite, consumer prices were up “only” 2.7% year over year in July, the same as the month prior. Core inflation, which excludes more volatile food and energy prices, was up 3.1% vs. forecasts for a 3% increase. Auto repairs and hospital services were big gainers year over year, posting about 10% and 5% increases, while smartphones and internet services saw significant price declines year over year. The re-acceleration in services costs demonstrates the challenge of beating inflation, analysts said. A sustained increase in services costs could mean an additional barrier to the Fed cutting rates, something President Trump and others in his administration have been strongly advocating for months now. As Trump’s policies come more clearly into focus, “the fog is lifting,” Richmond Fed President Barkin said last week. But, the balance between pressure on inflation vs. employment remains “unclear,” Barkin said. The Fed will continue to adjust its policy stance “as needed,” Barkin concluded.

Still, there are clearly some pockets of stress, including student loan borrowers. After repeated renewals of temporary pauses, those that owe on federal student loans are finally required to make payments again. But with facing a tightening employment market and other cost pressures, about two-third of student loan borrowers aren’t actually making payments.

Paxos Seeks OCC Trust Charter

Blockchain infrastructure and stablecoin issuer Paxos is looking to move from a state regulatory regime to a national one, the company said in a news release announcing it is applying for an OCC national trust charter. In addition to its own Pax Dollar (USDP), Paxos also issues a gold-backed stablecoin, “Global Dollar” (USDG), and PayPal’s stablecoin, PYUSD.

The company currently holds a New York-issued state trust charter, which it is seeking to convert to a national one. Paxos cofounder and CEO Charles Cascarilla emphasized the company’s dedication to compliance, saying in the release, “For over a decade, Paxos has set the bar for regulatory oversight and compliance. By applying for a national trust bank charter, we are continuing to offer enterprise partners and consumers the safest, most trusted infrastructure available. This is rooted in our belief in the transformative power of blockchain as a force for financial freedom. OCC oversight will help build on our historic commitment to maintaining the highest standards of safety and transparency.”

NY AG Sues Zelle Parent Early Warning

New York Attorney General Letitia James is picking up the slack from the CFPB, it seems. James filed a lawsuit last week against Early Warning Services, the bank-owned consortium that operates the Zelle peer-to-peer payment service. The lawsuit alleges EWS permitted fraud on the Zelle network for years, costing consumers more than $1Bn in losses. James alleges EWS had plans to implement fraud controls on Zelle, but waited years to do so, according to a press release from the attorney general’s office. A spokesperson for Early Warning commented on the suit, saying, “This is nothing more than a copycat of the Consumer Financial Protection Bureau lawsuit that was dismissed in March. Despite the Attorney General’s assertions, they did not conduct an investigation of Zelle.”

Dispute Automation Platform Raises $25MM Series A

Dispute automation platform Casap has raised a $25MM Series A, the company announced last week. The round was led by Emergence Capital, with participation from Primary Venture Partners, Lightspeed Venture Partners, and SoFi. Casap, founded by a former product lead at Robinhood, is developing a “post-transaction” risk management platform, to help issuers handle the entire payments dispute lifecycle, including evidence collection, outcome prediction, and chargeback filing.

Riva Money Bags $3MM For New Money Transfer App

Alums of neobank Revolut and remittance firm Wise have raised $3MM for a new blockchain-powered money transfer startup dubbed Riva Money. Investors in the pre-seed round include Project A and angels from Monzo, Revolut, and JPMorgan. Riva will automatically route cross-border payments via blockchain/stablecoin or traditional rails, depending on what is most effective. Company cofounder and CEO Hoejman emphasized the importance of compliance, saying, “By combining blockchain technology with a robust regulatory framework, we’re building a solution that offers businesses the speed, transparency and cost-efficiency they need to thrive in today’s interconnected economy.”

Transak Announces $16MM Fundraise

Another payments infrastructure company, Transak, announced it has raised $16MM to scale its platform. The round was led by IDG Capital, with participation from KX VC, Fuel Ventures, Umami Capital, and others. Transak provides “on and off ramp” infrastructure, enabling users to move funds between local fiat currencies and stablecoins via domestic payment rails in 75 countries. The company currently operates in the U.S., U.K., and E.U., and, with the fresh funding, plans to expand its coverage into the Middle East, Latin America, and Southeast Asia.

Western Union Acquires Intermex

In something of a counter-intuitive move, given the wider industry’s focus on digital distribution, Western Union announced it has acquired remittance firm Intermex for $500MM. Intermex serves some 6MM customers sending money primarily from the U.S., Canada, U.K., Germany, Italy, and Spain to over 60 countries via its website, mobile app, physical storefronts, and network of agents. Intermex has a particularly strong presence in LatAm, and Western Union emphasized the company’s “deep market knowledge,” strong agent relationships, and operational expertise as key reasons for the acquisition. Western Union expects to generate $30MM in annual run rate cost synergies within two years of closing the deal, the company said.

Meridian Link to Go Private in Deal Worth $2Bn

Private equity firm Centerbridge Partners is acquiring financial institution technology service provider MeridianLink in a deal that values the company around $2Bn. Current shareholders of MeridianLink will receive $20 per share, a 26% premium, in the all-cash deal. MeridianLink’s software is used by about 2,000 smaller banks and financial services companies to handle account opening, background screening, point-of-sale, data verification, collections, and related tasks. The transaction is expected to close by the end of this year.

.png)