Miran Pushes Rate Cut; Americans’ Job Worries

.png)

Inflation decelerates. Americans’ job worries. Paystand acquires Bitwage. Samsung wants to launch a credit card.

If you’re heading to Fintech Nerdcon next week don’t miss our CEO and Founder, Gilles Gade, on the Main Quest Stage, Thursday at 11:30am ET, for an engaging conversation tracing Cross River’s journey — from our early days to the challenges, lessons learned, and continued leadership in the future of BaaS.

New here? Subscribe here to get our newsletter each Sunday. For even more updates, follow us on LinkedIn

Inflation Decelerates on Merchant Discounting

Inflation for big-ticket consumer durables and personal goods increased more slowly in October, per price data from OpenBrand. OpenBrand data showed price hikes of 0.22% for durables and personal goods in October vs. 0.48% in September. Merchant discounts helped slow price increases, with the size of discounts hitting 20.4%. Despite uneven progress on inflation, Fed Governor Stephen Miran is vocally advocating for the Fed to make additional rate cuts. Appearing on CNBC last week, Miran pushed for a half-point cut, saying, “We could get data that would make me change my mind between now and then. But barring new information that would alter my forecasts, I think 50 basis points is appropriate, as I've said in the past but at a minimum 25.”

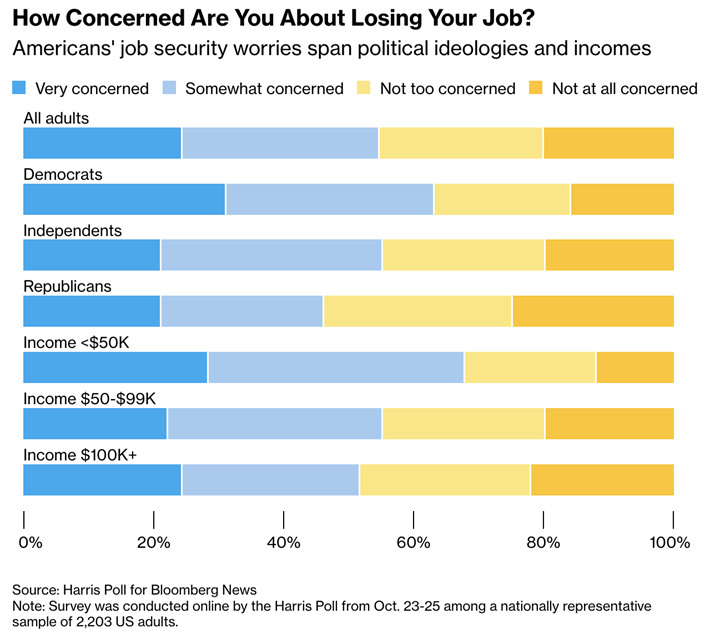

Costs are not the only challenge on Americans’ minds. Despite some describing the current employment climate as “no hire, no fire,” U.S. workers are increasingly concerned about losing their job, survey data shows. Per a Harris Poll for Bloomberg News, nearly half of workers think it would take at least four months to find a new job, should they lose their existing one. Meanwhile, signs of borrower stress, particularly for lower-income and subprime borrowers, continue to emerge. Per Fitch Ratings data, the share of subprime borrowers 60 or more days past due on their auto loan climbed to 6.65% in October, the highest since Fitch began collecting such data in 1994.

Paystand Acquires Bitwage

B2B payments firm Paystand has acquired Bitwage, the companies announced last week. Bitwage leverages stablecoins and cryptocurrencies to power crossborder B2B payments, complementing Paystand’s existing business. The acquisition will enable new capabilities for Paystand, including in foreign exchange, bulk payouts, and vendor payments. Paystand claims the acquisition makes it “the first network to offer enterprise-scale, compliant, programmable money movement that connects real businesses - not just banks or exchanges - into the on-chain economy.” Terms of the transaction were not disclosed.

Samsung Wants to Launch a Credit Card

South Korean electronics giant and mobile phone maker Samsung wants to launch a U.S. credit card, the Wall Street Journal is reporting. The company is in talks with U.K. bank Barclays, whose primary presence in the U.S. is via cobranded credit card programs. Samsung views a credit card as an avenue to build deeper inroads into consumers’ day-to-day financial lives, something Apple has achieved through Apple Wallet, Apple Pay, and Apple Card, although the economics of the Apple Card have been something of an albatross for Apple’s bank partner, Goldman Sachs. Samsung and Barclays are hoping to finalize and announce a deal by the end of the year, according to people familiar with the negotiations, though the companies have missed earlier deadlines and there’s no guarantee they will reach a deal.

.png)