Labor Market Softening; Figure Plans IPO; Klarna Delinquencies Improving

.png)

A “concerning” jobs report. Daloopa, Stavtar, Blue J, Saphyre announce fundraises. Figure files for IPO. Grasshopper raises $46.6MM. Klarna says delinquencies improving.

What does it mean to be an early adopter of digital assets? Check out what Cross River’s leaders, as well as Gemini CFO Dan Chen, have to say.

New here? Subscribe here to get our newsletter each Sunday. For even more updates, follow us on LinkedIn.

A “Concerning” Jobs Report

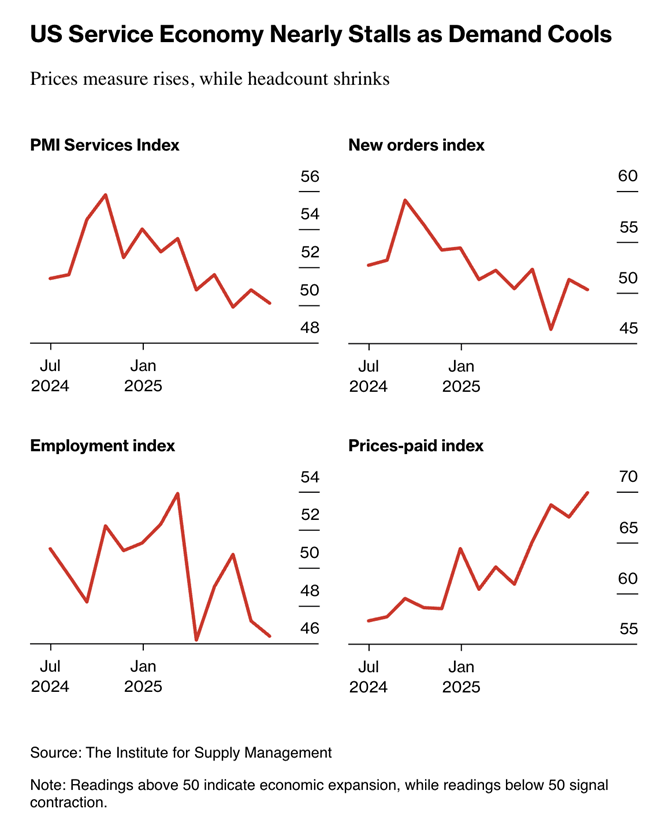

“Concerning” is the word Fed Governor Lisa Cook used to describe the July jobs report. Cook said the report could signal a shift in the labor market. Cook remarked during a conference last week that “the revisions are somewhat typical of turning points.” The revision Cook was referencing was the downward adjustment of employment gains in May and June by a combined 260,000 jobs. In July, employers added fewer workers than expected, with just 73,000 new jobs created. The services sector is stagnant, with companies in the sector reducing headcount. The Institute for Supply Management’s services index dropped below 50.1, indicating a contraction in the sector. And the ISM’s employment index dropped to 46.4, the lowest reading since the COVID pandemic.

With some softness in the job market and lingering inflation, it’s not too surprising that U.S. consumers are pulling back on spending. Consumer spending was roughly flat in the first half of the year, and there are signs that household budgets are stretched. Shoppers are increasingly trying to economize by buying in bulk or shifting to generic brands. Use of coupons is up, and some consumers are cutting back on discretionary purchases, like alcohol or foreign vacations.

Daloopa, Stavtar, Blue J, Saphyre Announce Fundraises

Data infrastructure startup Daloopa has raised a $13MM strategic investment from existing and new investors, including Pavilion Capital. The company’s AI-powered data platform helps equity investment and research teams to leverage large language models and AI agents. Daloopa recently launched its Model Context Protocol, to help bridge the gap between structured, sourced financial data and LLMs. The company plans to use the new funding to enhance its product capabilities, further its LLM integrations, and to expand product capabilities.

Meanwhile, Stavtar, a spend and expense management platform, announced it has raised a $55MM Series A from VC firm Elephant. Stavtar focuses on serving complex businesses, such as alternative asset managers, assisting them in how they manage business spend and allocate costs. The company plans to use the new funding to expand integrated payment capabilities and to continue developing its flagship product, StavPay.

In other funding news, tax research startup Blue J announced it has raised a $122MM Series D. The round was led by Oak HC/FT and Sapphire Ventures, with participation from Intrepid Growth Partners and Ten Coves Capital. Toronto-based Blue J offers a “verticalized” generative AI platform focused on tax research, which allows users to ask tax questions using a conversational interface. Blue J’s platform spans U.S. federal, state, and local tax law and regulation, as well as Canadian and U.K. tax law. Of the fundraise news, Blue J cofounder and CEO Benjamin Alarie said, “With this capital and industry support, we will accelerate innovation and deliver even greater value to tax professionals. We are building the future of tax. This is just the beginning.”

Finally, Saphyre, which develops software to automate finance operations, announced it has raised $70MM in growth equity from FTV Capital. Saphyre’s software platform offers solutions for securities funding management, legal agreement administration, and broker trading account management. The company plans to use the new funding to increase its market presence and to accelerate product development.

Figure Confidentially Files to IPO

Figure Technology Solutions, cofounded by SoFi veteran Mike Cagney, has filed confidentially to IPO, the company announced last week. The move comes less than a month after Figure Markets merged with Figure Technology Solutions, reversing the prior spinoff of Figure’s blockchain-focused business from its consumer credit marketplace. Cagney commented on the merger by saying, “With market adoption and Washington signaling growing blockchain support, the timing is right for Figure to lead the way. Figure is a consummate example of a blockchain company using the technology in real-world use cases to drive efficiency, speed and cost savings.” Given that Figure’s IPO filing is confidential, there are no details to report at this point, though the company said it expects to conduct a public offering of its securities “in 2025.”

Grasshopper Raises $46.6MM

Grasshopper, a startup digital-first bank, has announced a fresh $46.6MM in funding to power its next phase of growth. The round was led by Patriot Financial Partners, with participation from Glendon Capital Management. The investment is supporting Grasshopper’s merger with Auto Trust, making Grasshopper the exclusive bank powering deposit and credit offerings to approximately 13MM AAA members across 14 states. Through organic growth and the acquisition of Auto Trust, Grasshopper has seen total assets climb by 53% to $1.33Bn in the first half of 2025. On the funding news, Grasshopper CEO Mike Butler said, “The backing from this seasoned group of investors is a powerful vote of confidence in our mission, our strategy and our team. We’re incredibly proud of the momentum we’ve built, and we’re just getting started. This capital gives us the opportunity to continue pushing boundaries, broaden our reach, and unlock new possibilities in how we deliver meaningful, future-ready digital banking experiences that meet people where they are and anticipate where they’re headed next.”

Klarna Says Delinquencies Improving

Klarna published updated performance metrics on its BNPL portfolio last week, which, the company says, demonstrate improving consumer health. According to the company, “a record number of transactions were repaid on time or early,” across both smaller and larger transactions financed on the platform. The company’s delinquency rate on BNPL loans (pay-in-four and pay in 30 days) improved by (15)bps to 0.88% in Q2. Delinquencies on longer-term interest-bearing loans of 6 to 12 months were basically flat year over year, coming in at 2.18% in Q2. Klarna CEO and cofounder Sebastian Siemiatkowski commented, “More customers are paying us back on time or even early, with delinquency rates continuing to decline: proof that our model is working exactly as intended. When you build credit products that are fair, transparent, and designed with the consumer in mind, people make responsible choices.”

But while arch rival Affirm has decided to begin furnishing data on its shorter duration loans, Klarna so far has not, saying that it won’t do so until it is assured its customers won’t be “unfairly penalized.” The credit bureaus and credit score giant FICO have slowly but surely made progress on incorporating BNPL data into consumers’ credit reports and scores. Scoring models like FICO include new credit account openings as a data point, which can lower consumers’ scores.

.png)