FOMC Minutes; McKernan Confirmed at Treasury; First Brands Bankruptcy

.png)

Fed expects two rate cuts by end of year. McKernan confirmed for Treasury role. Supreme Court won’t hear Lisa Cook case till 2026. FDIC and OCC look to define “unsafe or unsound.” Fifth Third to acquire Comerica. Lineage forced to recapitalize. Bank of North Dakota announces its own stablecoin. Baselane announces Series B.

Edge Focus announced the closing of its second asset-backed securitization, EDGEX 2025-2, a $200 million Rule 144A transaction backed by unsecured consumer loans. The transaction was led by Performance Trust Capital Partners (Structuring Agent) and CRB Securities, LLC, with Nelnet Bank serving as co-sponsor.

New here? Subscribe here to get our newsletter each Sunday. For even more updates, follow us on LinkedIn.

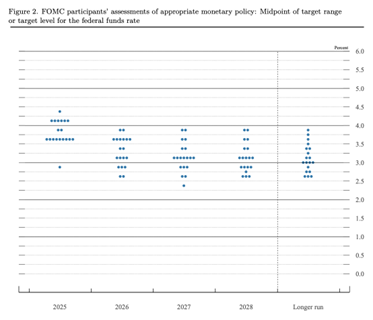

FOMC Expects Two More Rate Cuts by EOY

Minutes from the most recent Federal Open Market Committee meeting show officials are divided over how much further to cut rates through the end of the year. The group is nearly evenly split, 10-9, with the paper-thin majority expecting two further rate cuts by the end of the year. While the meeting minutes show that some preferred a more cautious approach to cutting rates, officials seem to be increasingly concerned about the health of the labor market. According to the meeting minutes, “Most participants observed that it was appropriate to move the target range for the federal funds rate toward a more neutral setting because they judged that downside risks to employment had increased over the intermeeting period and that upside risks to inflation had either diminished or not increased.”

The Fed’s job isn’t made any easier by a lack of official jobs numbers, owing to the ongoing shutdown of the federal government. In the absence of official Bureau of Labor Statistics metrics, analysts are paying increased attention to private data sources and analysis, including from Bank of America, Goldman Sachs, and the Carlyle Group. Non-governmental data sources are telling a consistent and troubling story. Namely, that few firms are actually hiring. Though hiring has slowed, layoffs still remain relatively sparse, with many employers instead choosing to shrink through attrition.

Former FDIC Director Confirmed for Treasury Role

The U.S. Senate has confirmed former FDIC Director Jonathan McKernan for as the under secretary for domestic finance at the Department of the Treasury. McKernan was confirmed with a 51-47 vote roughly along party lines. McKernan was nominated to the FDIC board in 2022 by President Joe Biden. President Trump had nominated McKernan to lead the Consumer Financial Protection Bureau. That nomination was ultimately withdrawn back in May, with Trump nominating McKernan to the role at Treasury instead.

Supreme Court Won’t Rule on Cook Firing Till 2026

The U.S. Supreme Court has opted to delay making a decision on the fate of Federal Reserve Governor Lisa Cook. President Trump is attempting to fire Cook, citing unsubstantiated allegations that she committed mortgage fraud by listing an Atlanta property as her “primary” residence. The Justice Department has reportedly opened an investigation related to the matter, but no charges have been filed. Last month, a federal judge ruled that Cook could stay in her role as a Fed governor while her lawsuit challenging her firing works its way through the courts. Oral arguments in Cook’s case at the Supreme Court aren’t scheduled to take place until early next year, meaning she will stay in her role, including as part of the FOMC voting on rate decisions, at least until then.

FDIC and OCC Look to Narrowly Define “Unsafe or Unsound” Practices

The FDIC and OCC are proposing to narrow how they supervise banks under their jurisdiction. In a joint notice of proposed rulemaking issued last week, the regulators are proposing to more narrowly define what qualifies as an “unsafe or unsound practice.” The proposed rule would codify a definition “as a practice, act, or failure to act, alone or together with other practices, acts, or failures to act, that is contrary to generally accepted standards of prudent operation” and has harmed or, if continued, is likely to harm the financial condition of the bank or present a material risk of loss to the deposit insurance fund. Per a bulletin announced the proposed rule, the intention is to “prioritize material financial risks over concerns related to policies, process, documentation and other nonfinancial risks.” The proposed rule also would limit when bank examiners can issue “Matters Requiring Attention” (OCC) or “Matters Requiring Board Attention (FDIC) by limiting their use to practice that “could reasonably be expected to, under current or reasonably foreseeable conditions, materially harm the financial condition of the institution or present a material risk of loss.”

Fifth Third to Acquire Comerica

Fifth Third announced its intention to acquire Comerica in a nearly $11Bn deal last week. The all-stock transaction, if approved and finalized, would create a top-20 bank with some $288Bn in assets, per regulatory data. This isn’t Fifth Third’s first attempt to bulk up. The bank put in a bid for failed First Republic during the 2023 regional banking crisis, but ultimately lost out to JPMorgan Chase. Acquiring Comerica will boost Fifth Third’s presence in key markets that include Texas, California, and Arizona.

Lineage, Once A Synapse Partner, Recapitalizing

Tiny Lineage Bank, one of the partner banks caught up in the Synapse meltdown, is being recapitalized, Fintech Business Weekly’s Jason Mikula reported last week. While less well known than Evolve, Lineage provided some payment processing services to Synapse and its fintech programs. The small bank has posted recurring losses as it manages the fallout from the failed partnership. A Tennessee based group of investors, operating through the entity Recap Financial Ventures LLC, submitted an application to the Federal Reserve to form a bank holding company and for approval of a change in control, as the contemplated investment would give the group a controlling stake in Lineage’s bank holding company, Lineage Financial Network.

Bank of North Dakota Announces Its Own Stablecoin

The Bank of North Dakota is working with Fiserv to launch its “Roughrider Coin.” Per the companies’ statement, the stablecoin will be fully backed by U.S. dollars. The Bank of North Dakota is the only state-owned bank in the United States and focuses on promoting agriculture, commerce, and industry in the state. The Roughrider Coin is intended “to increase bank-to-bank transactions, encourage global money movement, and drive merchant adoption.” The stablecoin will begin rolling out to banks and credit unions in the state in 2026.

Baseline Announces Series B

Real estate investor platform Baselane announced it has raised a $20MM Series B led by Thomvest Ventures. The company also revealed a previously unannounced $14MM Series A, led by Matrix Partners. The company launched in 2022 to offer an integrated real estate investing management platform. Baselane, according to the company, now supports some 50,000 investors who own or manage a combined 25MM rental units. Baselane simplifies property management by offering integrated payments, accounting, and tax capabilities. Baselane cofounder and CEO Mathias Korder described the product by saying, “We built Baselane to give landlords back time and control. By automating the financial back-office, we’re helping them save 5, 8, even 12 hours a week — while still staying on top of cash flow and helping them manage larger portfolios without adding more work.” The company plans to use the funding to accelerate product development and scale its go-to-market efforts.